Chapter 8 Regression and classification

Chapter lead author: Pepa Aran

8.1 Learning objectives

After completing this tutorial, you will be able to:

- Understand the basics of regression and classification models.

- Fit linear and logistic regression models in R.

- Choose and calculate relevant model performance metrics.

- Evaluate and compare regression models.

- Detect data outliers.

- Select best predictive variables.

Contents of this Chapter are inspired and partly adopted by the excellent book by Boehmke and Greenwell.

8.2 Tutorial

8.2.1 Types of models

Models try to explain relationships between variables through a mathematical formulation, particularly to predict a given target variable using other explanatory variables, also called predictors. Generally, we say that the target variable \(Y\) is a function (denoted \(f\)) of a set of explanatory variables \(X_1, X_2, \dots, X_p\) and some model parameters \(\beta\). Models can be represented as: \[Y \sim f(X_1, X_2, \dots, X_p, \beta)\]

This is a very general notation and depending on the structure of these components, we get to different modelling approaches.

The first distinction comes from the type of target variable. Whenever \(Y\) is a continuous variable, we are facing a regression problem. If \(Y\) is categorical, we speak of classification.

| Regression | Classification | |

|---|---|---|

| Target variable | Continuous | Categorical |

| Common models | Linear regression, polynomial regression, KNN, tree-based regression | Logistic regression, KNN, SVM, tree classifiers |

| Metrics | RMSE, \(R^2\), adjusted \(R^2\), AIC, BIC | Accuracy, precision, AUC, F1 |

8.2.2 Regression

In this section, we will introduce the most basic regression model - linear regression. We will explain how to fit the model with R, how to include categorical predictors and polynomial terms. Finally, several performance metrics for regression models are presented.

8.2.2.1 Linear regression

Theory

Let’s start with the simplest model: linear regression. You probably have studied linear regression from a statistical perspective. Here, we will take a data-fitting approach.

For example, we can try to explain the relationship between GPP and short wave radiation, like in Chapter 4. The figure below shows a cloud of data points, and a straight line predicting GPP based on observed shortwave radiation values.

# read and format data from Ch 3

half_hourly_fluxes <- readr::read_csv("./data/FLX_CH-Lae_FLUXNET2015_FULLSET_HH_2004-2006_CLEAN.csv")

set.seed(2023)

plot_1 <- half_hourly_fluxes |>

sample_n(2000) |> # to reduce the dataset

ggplot(aes(x = SW_IN_F, y = GPP_NT_VUT_REF)) +

geom_point(size = 0.75, alpha = 0.4) +

geom_smooth(method = "lm", color = "red", se = FALSE) +

labs(x = expression(paste("Shortwave radiation (W m"^-2, ")")),

y = expression(paste("GPP (gC m"^-2, "s"^-1, ")"))) +

theme_classic()

segment_points <- data.frame(x0 = 332, y0 = 3.65, y_regr = 8.77)

plot_1 +

geom_segment(aes(x = x0, y = y0, xend = x0, yend = y_regr),

data = segment_points,

color = "blue", lwd = 1.2, alpha = 0.8)

To reproduce this code chunk, you can download the file

FLX_CH-Lae_FLUXNET2015_FULLSET_HH_2004-2006_CLEANfrom here and read it from the local path where the file is stored on your machine. All data files used in this tutorials are stored here.

We want to find the best straight line that approximates a cloud of data points. For this, we assume a linear relationship between a single explanatory variable \(X\) and our target \(Y\): \[ Y_i \sim \beta_0 + \beta_1 X_i, \;\;\; i = 1, 2, ...n \;, \] where \(Y_i\) is the i-th observation of the target variable, and \(X_i\) is the i-th value of the (single) predictor variable. \(n\) is the number of observations we have and \(\beta_0\) and \(\beta_1\) are constant coefficients (model parameters). We call \(\beta_0\) the intercept and \(\beta_1\) the slope of the regression line. Generally, \(\hat{Y}\) denotes the model prediction.

Fitting a linear regression is finding the values for \(\beta_0\) and \(\beta_1\) such that, on average over all points, the distance between the line at \(X_i\), that is \(\beta_0 + \beta_1 X_i\) (blue segment in the plot above), and the observed value \(Y_i\), is as small as possible. Mathematically, this is minimizing the sum of the square errors, that is: \[ \min_{\beta_0, \beta_1} \sum_i (Y_i - \beta_0 - \beta_1 X_i)^2 . \] This linear model can be used to make predictions on new data, which are obtained by \(\hat{Y}_\text{new} = \beta_0 + \beta_1 X_\text{new}\). When the new data comes from the same distribution as the data used to fit the regression line, this should be a good prediction.

It’s not hard to imagine that the univariate linear regression can be generalized to a multivariate linear regression, where we assume that the target variable is a linear combination of \(p\) predictor variables: \[Y \sim \beta_0 + \beta_1 X_1 + \beta_2 X_2 + \; ... \; + \beta_p X_p \;.\] Note that here, \(X_1, \dots, X_p\) and \(Y\) are vectors of length corresponding to the number of observations in our data set (\(n\) - as above). Analogously, calibrating the \(p+1\) coefficients \(\beta_0, \beta_1, \beta_2, ..., \beta_p\) is to minimize the sum of square errors \(\min_{\beta} \sum_i (Y_i - \hat{Y}_i)^2\).

While the regression is a line in two-dimensional space for the univariate case, it is a plane in three-dimensional space for bi-variate regression, and hyperplanes in higher dimensions.

Implementation in R

To fit a univariate linear regression model in R, we can use the lm() function. Already in Chapter 3, we created linear models by doing:

# numerical variables only, remove NA

df <- half_hourly_fluxes |>

dplyr::select(-starts_with("TIMESTAMP")) |>

tidyr::drop_na()

# fit univariate linear regression

linmod1 <- lm(GPP_NT_VUT_REF ~ SW_IN_F, data = df)Here, GPP_NT_VUT_REF is \(Y\), and SW_IN_F is \(X\). The formula notation GPP_NT_VUT_REF ~ SW_IN_F is common in R and can be used for a most functions in different packages. The (single) variable to the left of the ~ is the target variable (\(Y\)). The variable to its right is the predictor. Of course, we can include multiple predictors for a multivariate regression, for example as:

# fit multivariate linear regression

linmod2 <- lm(GPP_NT_VUT_REF ~ SW_IN_F + VPD_F + TA_F, data = df)The shorthand for including all predictors that are available in the data (here, all columns other than GPP_NT_VUT_REF in df), we can write:

linmod3 <- lm(GPP_NT_VUT_REF ~ ., data = df)linmod* is now a model object of class "lm". It is a list containing the following components:

ls(linmod1)## [1] "assign" "call" "coefficients" "df.residual"

## [5] "effects" "fitted.values" "model" "qr"

## [9] "rank" "residuals" "terms" "xlevels"Enter ?lm in the console for a complete documentation of these components and other details of the linear model implementation.

R offers a set of generic functions that work with this type of object. The following returns a human-readable report of the fit. Here the residuals are the difference between the observed target values and the predicted values.

summary(linmod1)##

## Call:

## lm(formula = GPP_NT_VUT_REF ~ SW_IN_F, data = df)

##

## Residuals:

## Min 1Q Median 3Q Max

## -38.699 -2.092 -0.406 1.893 35.153

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.8732273 0.0285896 30.54 <2e-16 ***

## SW_IN_F 0.0255041 0.0001129 225.82 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 5.007 on 41299 degrees of freedom

## Multiple R-squared: 0.5525, Adjusted R-squared: 0.5525

## F-statistic: 5.099e+04 on 1 and 41299 DF, p-value: < 2.2e-16We can also extract coefficients \(\beta\) with

coef(linmod1)## (Intercept) SW_IN_F

## 0.87322728 0.02550413and the residual sum of squares (which we wanted to minimize) with

sum(residuals(linmod1)^2)## [1] 1035309Although summary() provides a nice, human-readable output, you may find it unpractical to work with. A set of relevant statistical quantities are returned in a tidy format using tidy() from the broom package:

broom::tidy(linmod1)## # A tibble: 2 × 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 0.873 0.0286 30.5 1.25e-202

## 2 SW_IN_F 0.0255 0.000113 226. 0Model advantages and concerns

An advantage of linear regression is that the coefficients provide information that is straight-forward to interpret. We’ve seen above, that GPP_NT_VUT_REF increases by 0.0255 for a unit increase in SW_IN_F. Of course, the units of the coefficients depend on the units of GPP_NT_VUT_REF and SW_IN_F. This has the advantage that the data does not need to be normalised. That is, a linear regression model with the same predictive skills can be found, irrespective of whether GPP_NT_VUT_REF is given in (g C m\(^{-2}\)s\(^{-1}\)) or in (t C km\(^{-2}\) year\(^{-1}\)).

Another advantage of linear regression is that it’s much less prone to overfit than other algorithms. You’ll learn more about the concept of overfitting in Chapter 9. Not being prone to overfitting can also be a disadvantage: linear regression models are often not flexible enough to be effectively fit to the data. They are also not able to capture non-linearities in the observed relationship and, as we’ll see later in this chapter, they often fit the data less well and generate poorer predictions than more complex models.

A further limitation is that least squares regression requires \(n>p\). In words, the number of observations must be greater than the number of predictors. If this is not given, one can resort to stepwise forward regression, where predictors are sequentially added based on which predictor adds the most additional information at each step. We will encounter stepwise regression in the exercises.

When multiple predictors are linearly correlated, then linear regression cannot discern individual effects and individual predictors may appear statistically insignificant when they would be significant if covarying predictors were not included in the model. Such instability can get propagated to predictions. Again, stepwise regression can be used to remedy this problem. However, when one predictor covaries with multiple other predictors, this may not work. For many applications in Geography and Environmental Sciences, we deal with limited numbers of predictors. We can use our own knowledge to examine potentially problematic covariations and make an informed pre-selection rather than throwing all predictors we can possibly think of at our models. Such a pre-selection can be guided by the model performance on a validation data set (more on that in Chapter 10).

An alternative strategy is to use dimension reduction methods. Principal Component regression reduces the data to capture only the complementary axes along which our data varies and therefore collapses covarying predictors into a single one that represents their common axis of variation. Partial Least Squares regression works similarly but modifies the principal components so that they are maximally correlated to the target variable. You can read more on their implementation in R here.

8.2.2.2 Regression on categorical variables

In the regression within categories section of Chapter 4, we saw that when we separate the data into sub-plots, hidden patterns emerge. This information is very relevant for modeling, because it can be included in our regression model. It is crucial to spend enough time exploring the data before you start modeling, because it helps to understand the fit and output of the model, but also to create models that capture the relationships between variables better.

So far, we have only used continuous variables as explanatory variables in a linear regression. It is also possible to use categorical variables. To do this in R, such variables cannot be of class numeric, otherwise the lm() function treats them as continuous variables. For example, although the variable NIGHT is categorical with values 0 and 1, the model linmod3 treats it as a number. We must make sure that categorical variables have class character or, even better, factor.

# create month category

df_cat <- half_hourly_fluxes |>

mutate(MONTH = lubridate::month(TIMESTAMP_START)) |>

tidyr::drop_na() |>

dplyr::select(MONTH, GPP_NT_VUT_REF, SW_IN_F)

# fix class of categorical variables

df_cat <- df_cat |>

mutate(MONTH = as.factor(MONTH))Now we can fit the linear model again:

linmod_cat <- lm(GPP_NT_VUT_REF ~ MONTH + SW_IN_F, data = df_cat)

summary(linmod_cat)##

## Call:

## lm(formula = GPP_NT_VUT_REF ~ MONTH + SW_IN_F, data = df_cat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -36.212 -2.346 -0.223 2.200 34.416

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 1.6146109 0.0893693 18.067 < 2e-16 ***

## MONTH2 -1.8105447 0.1294675 -13.985 < 2e-16 ***

## MONTH3 -2.8800172 0.1264177 -22.782 < 2e-16 ***

## MONTH4 -2.5667281 0.1278097 -20.082 < 2e-16 ***

## MONTH5 -0.0288745 0.1273491 -0.227 0.820631

## MONTH6 0.4614556 0.1298069 3.555 0.000378 ***

## MONTH7 0.1697514 0.1283830 1.322 0.186100

## MONTH8 1.2942463 0.1231252 10.512 < 2e-16 ***

## MONTH9 0.5140562 0.1165474 4.411 1.03e-05 ***

## MONTH10 -0.4807082 0.1152536 -4.171 3.04e-05 ***

## MONTH11 -1.3370277 0.1159059 -11.535 < 2e-16 ***

## MONTH12 -1.2634451 0.1151530 -10.972 < 2e-16 ***

## SW_IN_F 0.0246420 0.0001169 210.810 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.865 on 41288 degrees of freedom

## Multiple R-squared: 0.5776, Adjusted R-squared: 0.5775

## F-statistic: 4704 on 12 and 41288 DF, p-value: < 2.2e-16In the fit summary, you can observe that, there are MONTH2 to MONTH12 parameters. MONTH is a factor which can take 12 different values: 1 to 12. lm() uses one of the factor level as the reference, in this case 1, and fits an intercept for the other categories. The result is a set of parallel regression lines, one for each different month.

df_cat |>

mutate(MONTH_NAME = lubridate::month(as.integer(MONTH), label = TRUE)) |>

ggplot(aes(x = SW_IN_F, y = GPP_NT_VUT_REF)) +

geom_point(alpha = 0.2) +

geom_smooth(formula = y ~ x + 0, method = "lm", color = "red", se = FALSE) +

labs(x = "SW", y = "GPP") +

facet_wrap(~MONTH_NAME) +

theme_classic()

In the grid image, we can observe that GPP does not increase with SW at the same rate every month. For example, the increase in GPP is less steep in February than in September. To model this, we should consider a variable slope parameter for each month or category. In R, this is implemented by including an interaction term MONTH:SW_IN_F in the regression formula, like this:

linmod_inter <- lm(GPP_NT_VUT_REF ~ MONTH + SW_IN_F + MONTH:SW_IN_F, data = df_cat)

# equivalently: lm(GPP_NT_VUT_REF ~ MONTH * SW_IN_F, data = df_cat)

summary(linmod_inter)##

## Call:

## lm(formula = GPP_NT_VUT_REF ~ MONTH + SW_IN_F + MONTH:SW_IN_F,

## data = df_cat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -28.891 -2.113 -0.420 1.892 34.029

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 2.0449603 0.0944991 21.640 < 2e-16 ***

## MONTH2 -1.5386938 0.1369424 -11.236 < 2e-16 ***

## MONTH3 -1.5249304 0.1365863 -11.165 < 2e-16 ***

## MONTH4 -1.0050639 0.1396023 -7.199 6.15e-13 ***

## MONTH5 -0.4502367 0.1412720 -3.187 0.00144 **

## MONTH6 -1.2559057 0.1474257 -8.519 < 2e-16 ***

## MONTH7 -0.8440097 0.1446838 -5.833 5.47e-09 ***

## MONTH8 -0.2188300 0.1346734 -1.625 0.10419

## MONTH9 -1.3407190 0.1269387 -10.562 < 2e-16 ***

## MONTH10 -0.9991456 0.1235627 -8.086 6.32e-16 ***

## MONTH11 -1.2124373 0.1230946 -9.850 < 2e-16 ***

## MONTH12 -1.0724209 0.1210819 -8.857 < 2e-16 ***

## SW_IN_F 0.0158600 0.0008758 18.110 < 2e-16 ***

## MONTH2:SW_IN_F -0.0030373 0.0011518 -2.637 0.00837 **

## MONTH3:SW_IN_F -0.0058229 0.0009713 -5.995 2.05e-09 ***

## MONTH4:SW_IN_F -0.0038333 0.0009469 -4.048 5.17e-05 ***

## MONTH5:SW_IN_F 0.0087370 0.0009305 9.389 < 2e-16 ***

## MONTH6:SW_IN_F 0.0135219 0.0009172 14.743 < 2e-16 ***

## MONTH7:SW_IN_F 0.0110791 0.0009182 12.066 < 2e-16 ***

## MONTH8:SW_IN_F 0.0151014 0.0009317 16.209 < 2e-16 ***

## MONTH9:SW_IN_F 0.0180496 0.0009297 19.415 < 2e-16 ***

## MONTH10:SW_IN_F 0.0097277 0.0009761 9.966 < 2e-16 ***

## MONTH11:SW_IN_F -0.0011415 0.0010932 -1.044 0.29640

## MONTH12:SW_IN_F -0.0099745 0.0012972 -7.689 1.52e-14 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.593 on 41277 degrees of freedom

## Multiple R-squared: 0.6237, Adjusted R-squared: 0.6234

## F-statistic: 2974 on 23 and 41277 DF, p-value: < 2.2e-168.2.2.3 Polynomial regression

Furthermore, the relationships between variables may be non-linear. In the previous example, we see that the increase in GPP saturates as shortwave radiation grows, which suggests that the true relationship could be represented by a curve. There are many regression methods that fit this kind of relationship, like polynomial regression, LOESS (local polynomial regression fitting), etc.

Let’s fit a simple quadratic regression model, just for the month of August. For this we use the poly() function which constructs orthogonal polynomials of a given degree. Here, a second-order polynomial (a parabola) is fitted:

quadmod <- lm(GPP_NT_VUT_REF ~ poly(SW_IN_F, 2),

data = df_cat |>

filter(MONTH == 8))

summary(quadmod)##

## Call:

## lm(formula = GPP_NT_VUT_REF ~ poly(SW_IN_F, 2), data = filter(df_cat,

## MONTH == 8))

##

## Residuals:

## Min 1Q Median 3Q Max

## -26.367 -2.055 -0.253 1.801 32.375

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 7.13084 0.07944 89.77 <2e-16 ***

## poly(SW_IN_F, 2)1 447.25113 4.61907 96.83 <2e-16 ***

## poly(SW_IN_F, 2)2 -151.08797 4.61907 -32.71 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.619 on 3378 degrees of freedom

## Multiple R-squared: 0.7556, Adjusted R-squared: 0.7555

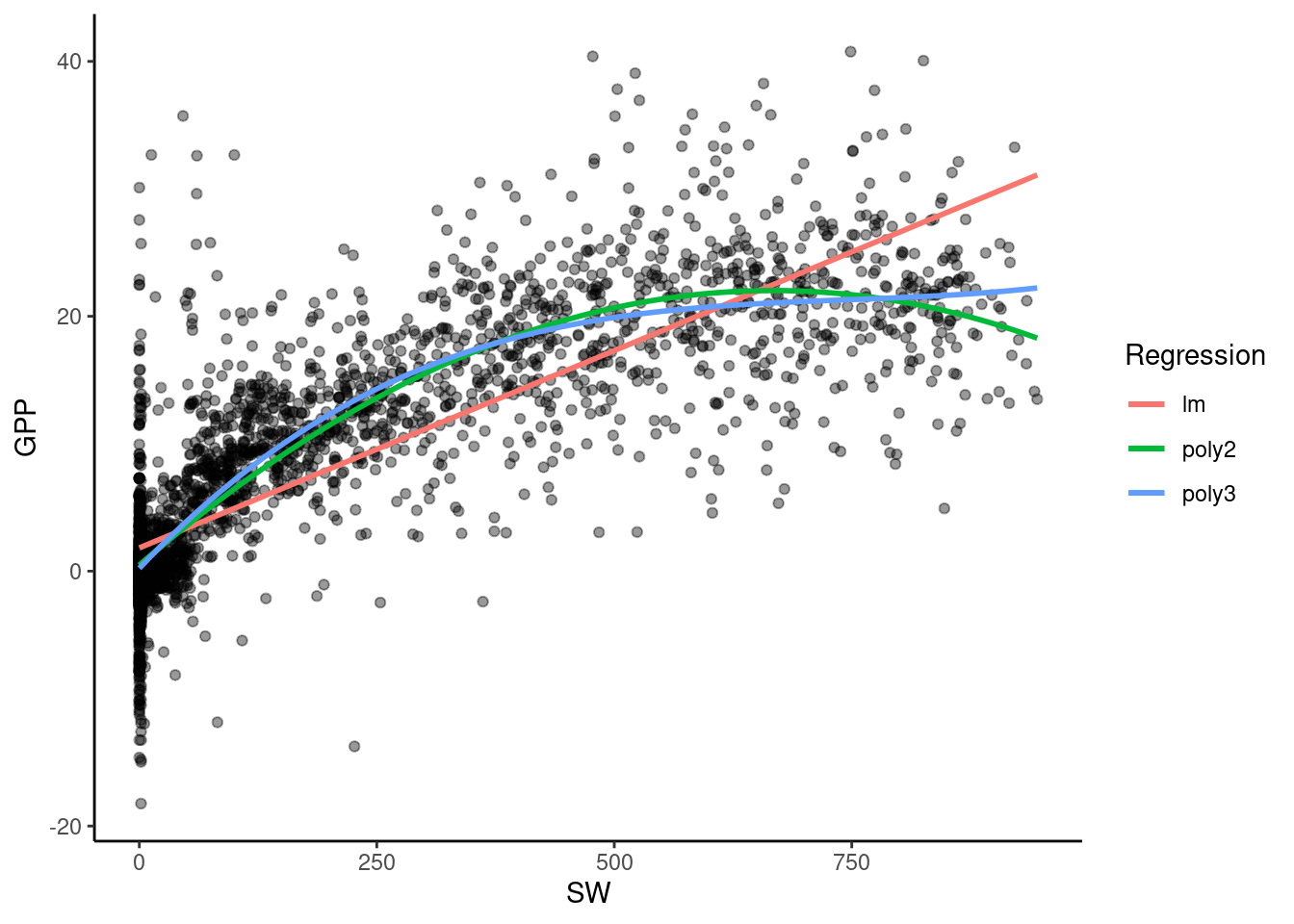

## F-statistic: 5223 on 2 and 3378 DF, p-value: < 2.2e-16In the following plot, you can see how the model fit for GPP in August improves as we consider higher degree polynomials:

df_cat |>

filter(MONTH == 8) |>

ggplot(aes(x = SW_IN_F, y = GPP_NT_VUT_REF)) +

geom_point(alpha = 0.4) +

geom_smooth(formula = y ~ x, method = "lm", aes(color = "lm"), se = FALSE) +

geom_smooth(formula = y ~ poly(x, 2), method = "lm",

aes(color = "poly2"), se = FALSE) +

geom_smooth(formula = y ~ poly(x, 3), method = "lm",

aes(color = "poly3"), se = FALSE) +

labs(x = "SW", y = "GPP", color = "Regression") +

theme_classic()

8.2.2.4 Metrics for regression evaluation

Metrics measure the quality of fit between predicted and observed values. Metrics are essential to model fitting, model selection, and for describing and quantifying patterns in the data. Metrics are also key for guiding the training of machine learning models, as you will learn in Chapter 10. Different metrics measure different aspects of the model-data agreement. In other words, a single metric never captures all aspects and patterns of the model-data agreement. Therefore, a visual inspection of the model fit is always a good start of the model evaluation.

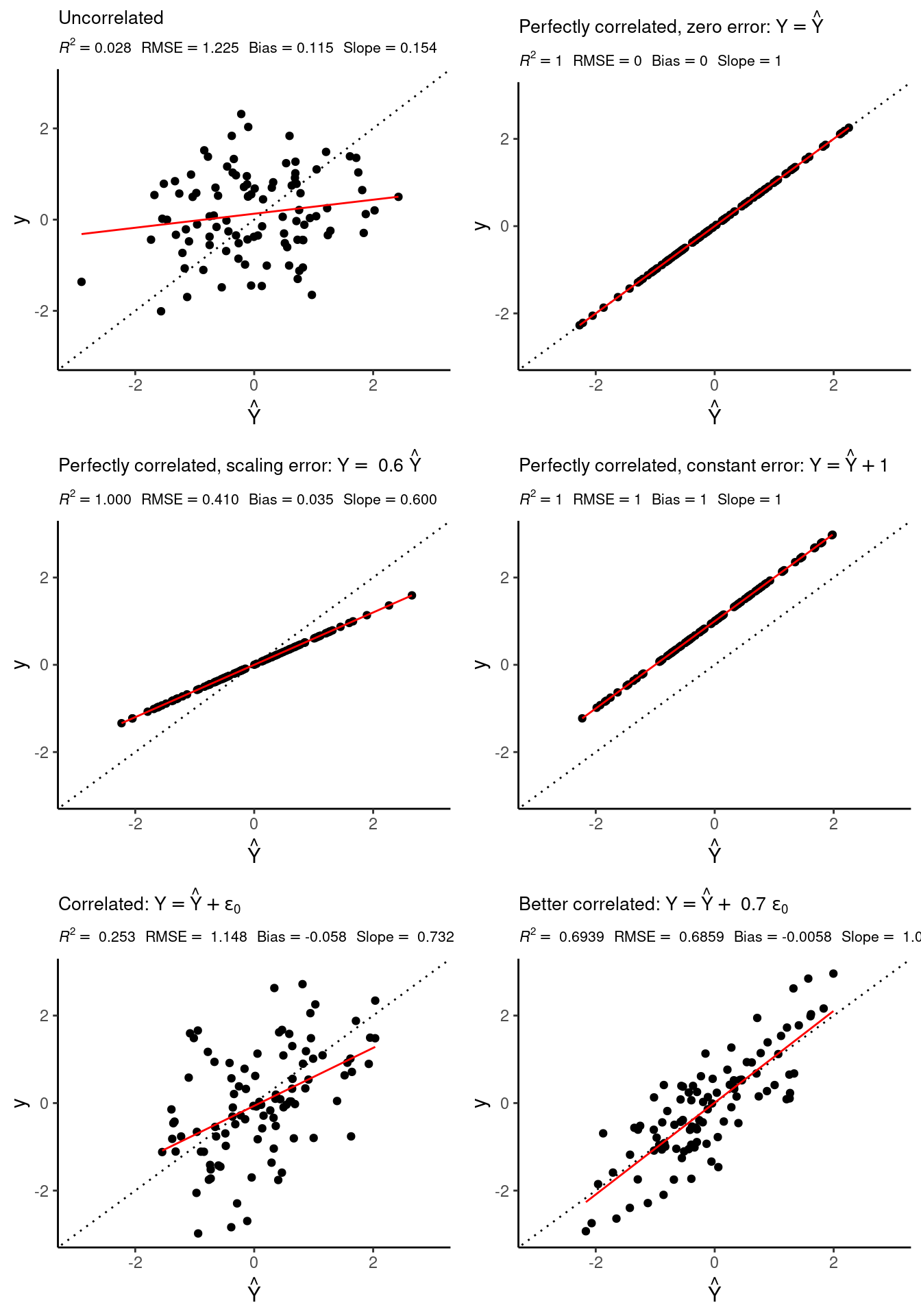

To get an intuitive understanding of the different abilities of different metrics, compare the scatterplots in Fig. 8.1 and how different aspects of the model-data agreement are measured by different metrics. The observed target values \(Y\) are plotted against the predicted values \(\hat{Y}\) from a regression model, and the dashed line represents the ideal fit: predictions matching the data perfectly. Definitions of the metrics displayed and other metrics are given below.

Figure 8.1: Correlation plots between observed and fitted target values.

Common metrics used for evaluating regression fits are:

MSE

The mean squared error is defined, as its name suggests, as: \[ \text{MSE} = \frac{1}{n} \sum_{i=1}^n (Y_i - \hat{Y_i})^2 \]It measures the magnitude of the errors, and is minimized to fit a linear regression or, as we will see in Chapter 9, during model training when used as a loss function. Note that since it scales with the square of the errors, the MSE is sensitive to large errors in single points, including outliers.

RMSE

The root mean squared error is, as its name suggests, the root of the MSE: \[ \text{RMSE} = \sqrt{\text{MSE}} = \sqrt{\frac{1}{n} \sum_{i=1}^n (Y_i - \hat{Y_i})^2} \]Like the MSE, the RMSE also measures the magnitude of the errors and is minimized during model training. By taking the square root of mean square errors, the RMSE is in the same units as the data \(Y\) and is less sensitive to outliers than the MSE.

MAE

The mean absolute error is similarly defined: \[ \text{MAE} = \frac{1}{n} \sum_{i = 1}^{n} |Y_i - \hat{Y_i}| \] Measuring the discrepancies between predictions and observations using absolute errors, instead of squared errors, gives less importance to errors of large magnitude and more importance to small errors than the MSE would. Hence, this measures is more stable in the presence of outliers.

\(R^2\) - coefficient of determination

describes the proportion of variation in \(Y\) that is captured by modelled values \(\hat{Y}\). It tells us how much better our fitted values \(\hat{Y}\) are than just taking the average of the target \(\bar{Y}\) as predictions. In this case, the goal is to maximize the metric, thus trying the explain as much variation as possible. In contrast to the MSE and RMSE, \(R^2\) measures consistency, or correlation, or goodness of fit. It is defined as: \[ R^2 = 1 - \frac{\sum_i (\hat{Y}_i - Y_i)^2}{\sum_i (Y_i - \bar{Y})^2}\\ \] When the regression model is fitted by minimizing the MSE, the \(R^2\) takes values between 0 and 1. A perfect fit is quantified by \(R^2 = 1\). There is no generally valid threshold of \(R^2\) for a model to be considered “good”. It depends on the application and the nature of the data and the data-generating process. Note that the above equation can also be written as \(R^2 = 1 - \text{MSE}/var(Y)\).

\(r\) - Pearson’s correlation

The linear association between two variables (here \(Y\) and \(\hat{Y}\)) is measured by the Pearson’s correlation coefficient \(r\). \[ r = \frac{\sum_i (Y_i - \bar{Y}) (\hat{Y_i} - \bar{\hat{Y}}) }{\sqrt{ \sum_i(Y_i-\bar{Y})^2 \; (\hat{Y_i}-\bar{\hat{Y}})^2 } } \]

The correlation calculated between the target \(Y\) and a predictor \(X\) can tell us about the predictive power of a regression model (the higher the correlation, the more powerful). We can also compute the correlation between the target \(Y\) and the predicted values \(\hat{Y}\) by a model (multivariate, or even not linear) to assess the adequacy of the model chosen. See Figure 8.1 as an example. It is noteworthy to mention that correlation is location and scale invariant, hence it will not detect model deviations like the ones in the middle row plots.

The squared value of the Pearson’s r is often reported as “\(R^2\)” but is not equivalent to the definition of the coefficient of determination given above. However, the square of the Pearson’s r is closely related to the coefficient of determination \(R^2\). For a linear regression, fitted by minimizing the MSE, they are identical (see proof here). In subsequent chapters, we will use “\(R^2\)” to refer to the square of the Pearson’s r between the observed \(Y\) and predicted \(\hat{Y}\) values.

Note the implementations in R.The \(R^2\) reported by the generic

summary()function corresponds to the base-R functioncor()^2, toyardstick::rsq(), and to the definition of the square of the Pearson’s \(r\) given above. Theyardstick::rsq_trad()returns the coefficient of determination as traditionally defined and is not equal to the values above, unless computed on the predicted values \(\hat{Y}\).

# generate correlated random data

set.seed(1982)

df <- tibble(x = rnorm(100)) |>

mutate(y = x + rnorm(100)) |>

mutate(y_fitted = lm(y ~ x)$fitted.values)

# implementations using Pearson's correlation

summary(lm(y ~ x, data = df))$r.squared## [1] 0.6186521cor(df$y, df$x)^2 # remember: location and scale invariant## [1] 0.6186521yardstick::rsq(df, y, x) |> pull(.estimate)## [1] 0.6186521(sum((df$x - mean(df$x))*(df$y - mean(df$y))))^2/

(sum((df$y - mean(df$y))^2)*sum((df$x - mean(df$x))^2))## [1] 0.6186521# implementations using coefficient of determination definition

1 - sum((df$x - df$y)^2) / sum((df$y - mean(df$y))^2) # should be \hat{y}, not x## [1] 0.5993324yardstick::rsq_trad(df, y, x) |> pull(.estimate) # incorrect## [1] 0.5993324yardstick::rsq_trad(df, y, y_fitted) |> pull(.estimate) # correct## [1] 0.6186521An “\(R^2\)” is commonly reported when evaluating the agreement between observed and predicted values of a given model. When the correlation between two different variables in a sample is quantified, \(r\) is commonly used to reflect also whether the correlation is positive or negative (\(r\) can attain positive or negative values in the interval \([-1, 1]\)). The coefficient of determination can return negative values when comparing observed and predicted values for uninformative estimates (worse than just using the average of \(Y\)) and is thus not actually bound between 0 and 1. Therefore, be careful with the interpreration of “\(R^2\)” and think on which variables it was computed and with which method.

Sometimes, the Person’s version is computed between \(Y\) and \(x\), and it leads to the same number due to its “location and scale invariant” property. Nevertheless, this is conceptually wrong, as we should look at the predictions, not the predictors: We are not predicting \(Y\) by just giving the values of \(x\) instead. Hence, especially when using {yardstick} functions, make sure you compute the values on \(\hat{Y}\). When we have several predictors, it’s already clear that we should compare \(Y\) to \(\hat{Y}\) instead of \(Y\) to each predictor separately.

Bias

The bias is simply the mean error: \[ \text{bias} = \frac{1}{n} \sum_i^n{(\hat{Y}_i - Y_i)} \]

Slope

The slope refers to the slope of the linear regression line between predicted and observed values. It is returned as the second element of the vector returned by coef(lm(..)):

coef(lm(y ~ y_fitted, data = df))[2]## y_fitted

## 18.2.2.5 Metrics for regression model comparison

In general, the aim of regression modelling is to find a model that best explains the data - but not the random errors in the data. More complex models tend to overfit more than simpler models. The implication of overfitting is that the model fits the data used for model fitting well, but doesn’t fit well when evaluating the predictions of the same model to new data (data not used for model fitting). In such a case, the model’s generalisability is poor. We’ll learn more about overfitting and generalisability in the context of supervised machine learning in later chapters. Often, simpler models generalise better than more complex model. The challenge is to strike a balance between complexity and generalisability. But how to find the “sweet spot” of this trade-off?

In this context it should be noted that the \(R^2\) always increases when predictors are added to a model. Therefore, the \(R^2\) is not a suitable metric for comparing models that differ with respect to their number of predictors - a factor controlling model complexity. Cross-validation can be regarded as the “gold-standard” for measuring model generalisability if the data is plentiful. It will be introduced in the context of supervised machine learning in Chapter 10. However, when the data size is small, cross validation estimates may not be robust. Without resorting to cross validation, the effect of spuriously improving the evaluation metric by adding uninformative predictors can also be mitigated by penalizing the number of predictors \(p\). Different metrics are available:

Adjusted \(R^2\)

The adjusted \(R^2\) discounts values of \(R^2\) by the number of predictors. It is defined as \[ {R}^2_{adj} = 1 - (1-R^2) \; \frac{n-1}{n-p-1} \;, \] where \(n\) (as before) is the number of observations, \(p\) the number of parameters and \(R^2\) the usual coefficient of determination. Same as for \(R^2\), the goal is to maximize \(R^2_{adj}\).

AIC

The Akaike’s Information Criterion is defined in terms of log-likelihood (covered in Quantitative Methoden) but for linear regression it can be written as: \[ \text{AIC} = n \log \Big(\frac{\text{SSE}}{n}\Big) + 2(p+2) \] where \(n\) is the number of observations used for estimation, \(p\) is the number of explanatory variables in the model and SSE is the sum of squared errors (SSE\(= \sum_i (Y_i-\hat{Y_i})^2\)). Also in this case we have to minimize it and the model with the minimum value of the AIC is often the best model for generalisations to new data. Since it penalizes having many parameters, it will favor less complex models.

AIC\(_c\)

For small values of \(n\) the AIC tends to select too many predictors. A bias-corrected version of the AIC is defined as: \[ \text{AIC}_c = \text{AIC} + \frac{2(p + 2)(p + 3)}{n-p-3} \] Also AIC\(_c\) is minimized for an optimal predictive model.

BIC

The Schwarz’s Bayesian Information Criterion is defined as \[ \text{BIC} = n \log \Big(\frac{\text{SSE}}{n}\Big) + (p+2) \log(n) \] Also for BIC, the goal is to minimize it. This metric has the feature that if there is a true underlying model, the BIC will select that model given enough data. The BIC tends to select a model with fewer predictors than AIC.

Implementation in R

Let’s calculate the metrics introduced above for a few of the fitted regression models. Some of these metrics, like \(R^2\) and \(R^2_{adj}\) are given by the summary() function. Alternatively, the {yardstick} package provides implementations for a few of these metrics, which we compute below:

compute_regr_metrics <- function(mod){

p <- length(mod$coefficients)

n <- length(mod$residuals)

tibble(

mse = mean(mod$residuals^2),

R2 = summary(mod)$r.squared,

R2_adj = summary(mod)$adj.r.squared,

AIC = extractAIC(mod)[2],

AIC_adj = extractAIC(mod)[2] + 2*(p+2)*(p+3)/(n-p-3),

BIC = BIC(mod) # this implementation is based on log-likelihood

)

}

list_metrics <- purrr::map(

list(linmod1, linmod2, linmod_cat, quadmod),

~compute_regr_metrics(.))

names(list_metrics) <- c("Linear model",

"Linear model 2",

"Linear + categories",

"Quadratic model")

bind_rows(list_metrics, .id = "type")## # A tibble: 4 × 7

## type mse R2 R2_adj AIC AIC_adj BIC

## <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 Linear model 25.1 0.553 0.553 133058. 133058. 250293.

## 2 Linear model 2 24.8 0.558 0.558 132590. 132590. 249842.

## 3 Linear + categories 23.7 0.578 0.577 130700. 130700. 248030.

## 4 Quadratic model 21.3 0.756 0.755 10350. 10350. 19972.8.2.3 Model selection

Model selection refers to several techniques that help you compare models and select the one that best explains the data. Here, concepts will be explained using regression as an example, but are directly translated to classification problems.

First, be systematic with model comparisons. Three key ideas in model selection are:

- Comparisons should be hierarchical: compare a model to another that “contains it”, i.e. compare

y ~ x1toy ~ x1 + x2, and noty ~ x1toy ~ x2 + x3. - Complexity must be increased slowly: add one variable at a time, not three variables all at once. This helps avoid collinearity in the predictors.

- Choose the most appropriate metric: if possible, a metric that accounts for model complexity and represents the goal of your analysis (e.g., recall for a classification where you don’t want to miss any positives).

If you’re considering different model approaches for the same task, you should first fit the best possible model for each approach, and then compare those optimized models to each other. For example, fit the best linear regression with your available data, the best KNN non-parametric regression model and a random forest. Then compare those three final models and choose the one that answers your research question the best.

One must be careful not to keep training or improving models until they fit the data perfectly, but maintain the models’ ability to generalize to newly available data. Chapter 9 introduces the concept of overfitting, which is central to data science. Think of model interpretation and generalization when comparing them, not only of performance. Simple models can be more valuable than very complex ones because they tell a better story about the data (e.g., by having few very good predictors rather than thousands of mediocre ones, from which we cannot learn the underlying relationships).

8.2.3.1 Variable selection

Let’s think of variable selection in the context of linear regression. A brute force approach to variable selection would be: Fit a linear regression for each combination of all available predictors, calculate a metric (e.g., AIC) and choose the best one (lowest AIC). The problem is, if you have, say, eight predictors, you would fit 40320 different regression models. This can be very computationally expensive.

Instead, take a hierarchical, or “greedy”, approach, starting with an empty model (just an intercept) and adding one variable at a time. This is called stepwise forward regression. The algorithm goes as follows:

- Set the number of predictors to be considered to \(p=1\).

- Fit all regression models with \(p\) predictors and compute their \(R^2\).

- Select the model with \(p\) predictors that achieves the highest \(R^2\) (best fitting model) and compute its AIC.

- Increment to \(p+1\). Fit all regression models with \(p+1\) predictors that include the predictor selected at the previous step and compute their \(R^2\). Select the best fitting model and compute its AIC.

- If the AIC of the model with \(p+1\) predictors is poorer than the AIC of the model with \(p\) predictors, retain the model with \(p\) predictors and quit. You have found the (presumably) optimal model. Otherwise, continue with with step 4.

Instead of the AIC, you may also use the BIC for model comparison. Note that algorithm doesn’t consider all possible combinations of predictors and it is possible that the globally optimal model is thus not found. The function stats::step() implements the stepwise algorithm in R.

This stepwise approach can also be done backwards, starting with a full model (all available variables) and removing one at a time. Or even with a back-and-forth approach, where you look at both including a new or removing an existing variable at each step (optimizing AIC). Furthermore, this algorithm can be applied to fitting a polynomial regression whereby the aim si to increase the degree of the polynomials - step by step. For a model with categorical variables, interaction terms should only be considered after having the involved variables as “intercept only”.

Multicollinearity exists when there is a correlation between multiple predictors in a multivariate regression model. This is problematic because it makes the estimated coefficients corresponding to the correlated variables unstable. Since correlated variables contain similar information, it doesn’t matter whether we include one or the other in the model or even if we include both of them. The performance metrics will be similar. Hence, it becomes difficult to conclude which variables actually influence the target.

The variance inflation factor (VIF) is a score from economics that measures the amount of multicollinearity in regression based on how the estimated variance of a coefficient is inflated due to its correlation with another predictor. It’s calculated as \[\text{VIF}_j = \frac{1}{1 - R^2_j},\] where \(R^2_j\) is the coefficient of determination for regressing the \(j^{th}\) predictor on the \(p-1\) remaining predictors. More specifically, \[R^2_j = 1 - \frac{\sum_i (X_{j, i} - \hat{X}_{j, i})^2}{\sum_i (X_{j, i} - \bar{X}_j)^2},\] where \(\hat{X}_{j, i}\) is the fitted value corresponding to the regression \(X_j \sim X_1 + ... X_{j-1} + X_{j+1} + ... + X_p\) for the \(i^{th}\) observation. A VIF\(_j\) is computed for each of the \(p\) predictors in the multivariate regression model we are evaluating, and their values interpreted to detect multicollinearity. Meaning: if \(\text{VIF}_j = 1\) variables are not correlated; if \(1 < \text{VIF}_j < 5\) there is moderate collinearity between \(X_j\) and the rest of predictors; and if \(\text{VIF}_j \geq 5\) they are highly correlated. Because variable \(X_{j}\) can be almost fully explained by all the other predictors (high \(R^2_j\)), this variable is redundant in our final model.

To remedy collinearity, you may choose to use only one or two of those correlated variables. Another option would be to use Principal Component Analysis (PCA), which you may read more about here. What PCA does is to map the space of predictors into another space of smaller dimension, leading to a smaller set of predictor variables \(\{Z_1, ... , Z_q\}\), each of them being a linear combination of all the initial available predictors, that is \(Z_1 = \alpha^1_0 + \alpha^1_1 X_1 + ... + \alpha^1_p X_p\), etc. If you have collinearity, those highly correlated variables would be summarized into one single new variable, called principal component.

When we work with high-dimensional data (that is, we have more variables than observations) there are better techniques to do variable selection than stepwise regression. Since the predictors space is so large, we could fit a line that passes through all the observations (a perfect fit), but does the model generalize? We don’t know. For example, Lasso and Ridge regression incorporate variable selection in the fitting process (you can check this post if you’re curious).

8.2.4 Outlier detection

Detecting outliers is important, because they can affect the fit of a model and render the model fitting not robust. When the data is large, individual points have less influence on the model fitting. Therefore, only outliers that are very far from normal values will affect the model fit (see below). Outliers are particularly problematic in the context of small data, because every value has a big influence on the fitted model.

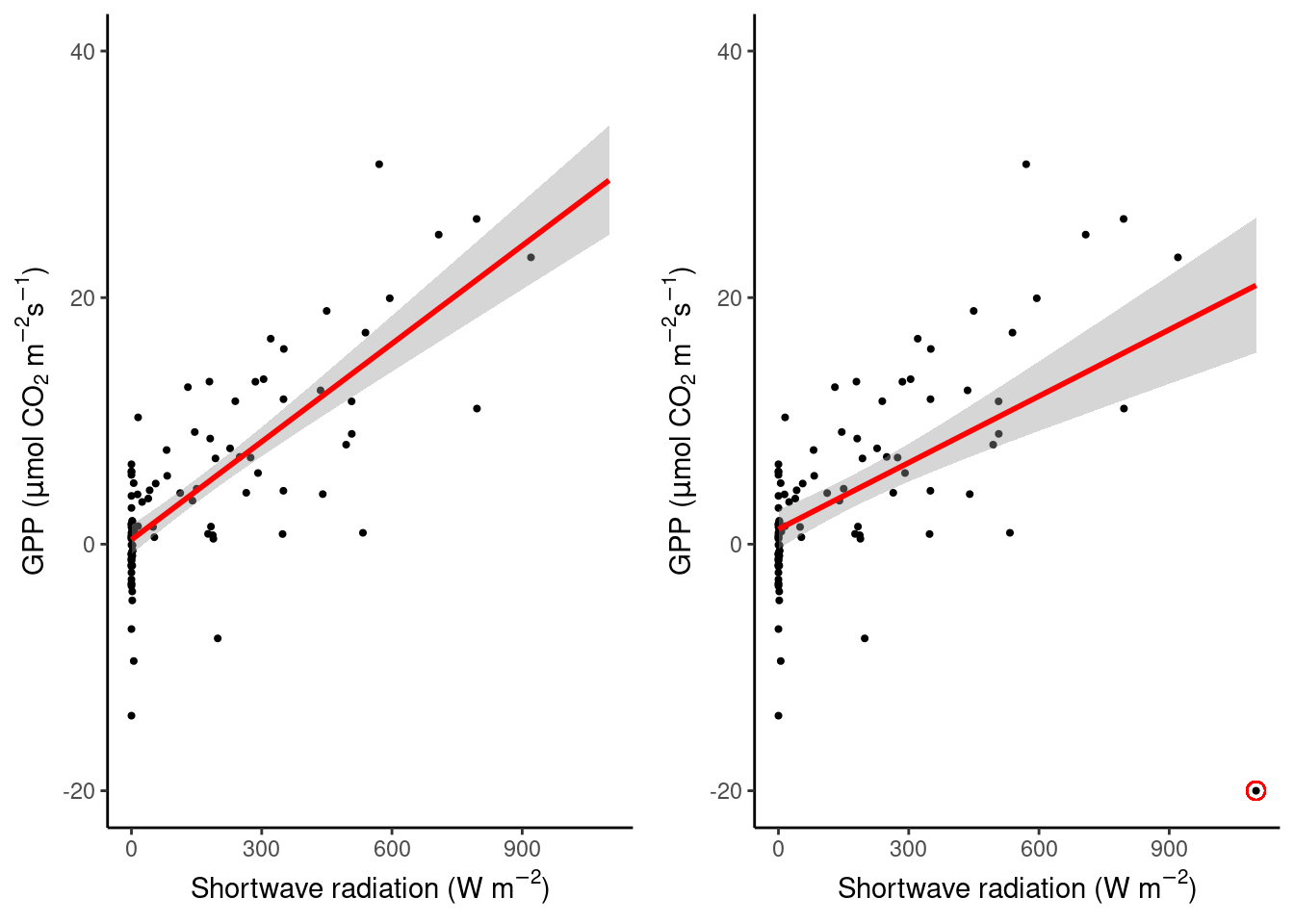

Take a look at the two linear regressions below and how one single point can strongly influence the fit. the added point (red circle around black dot) lies clearly outside the “cloud” of remaining points and doesn’t seem to follow the same pattern in the data.

set.seed(2023)

half_hourly_fluxes_small <- half_hourly_fluxes |>

sample_n(100) |> # reduce dataset

select(SW_IN_F, GPP_NT_VUT_REF)

plot_3 <- half_hourly_fluxes_small |>

ggplot(aes(x = SW_IN_F, y = GPP_NT_VUT_REF)) +

geom_point(size = 0.75) +

geom_smooth(method = "lm", color = "red", fullrange = TRUE) +

labs(x = expression(paste("Shortwave radiation (W m"^-2, ")")),

y = expression(paste("GPP (", mu,"mol CO"[2], " m"^-2, "s"^-1, ")"))) +

theme_classic() +

ylim(-20, 40) +

xlim(0, 1100)

plot_4 <- half_hourly_fluxes_small |>

add_row(SW_IN_F = 1100, GPP_NT_VUT_REF = -20) |> # add outlier

ggplot(aes(x = SW_IN_F, y = GPP_NT_VUT_REF)) +

geom_point(size = 0.75) +

geom_smooth(method = "lm", color = "red", fullrange = TRUE) +

labs(x = expression(paste("Shortwave radiation (W m"^-2, ")")),

y = expression(paste("GPP (", mu,"mol CO"[2], " m"^-2, "s"^-1, ")"))) +

theme_classic() +

geom_point(aes(x = 1100, y = -20), colour = 'red', shape = 1, size = 3) +

ylim(-20, 40) +

xlim(0, 1100)

cowplot::plot_grid(plot_3, plot_4)## `geom_smooth()` using formula = 'y ~ x'

## `geom_smooth()` using formula = 'y ~ x'

Figure 8.2: The influence of an outlier on a regression fit.

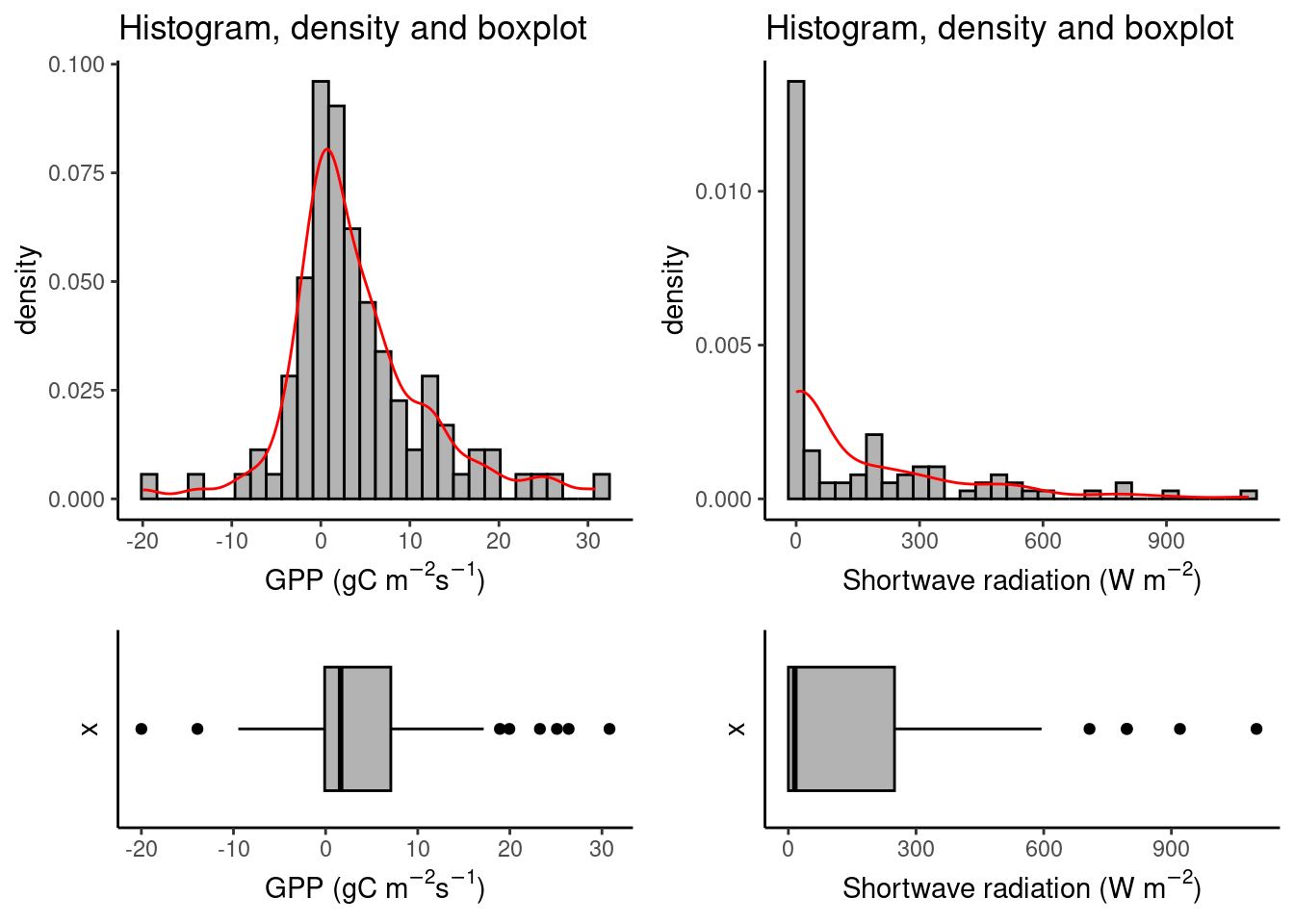

The first step to identifying outliers is usually to look at the data, one variable at a time. Plot a histogram to check the distribution of a variable. The shape of the distribution is very informative for what can be considered an outlier. In Chapters 3 and 4 it was introduced how to identify values that fall “outside” a distribution using histograms and boxplots. Checking in the histogram if the distribution has fat tails helps to discern whether the values that pop out of a boxplot should be considered outliers or not.

# create an outlier for demonstration purposes

half_hourly_fluxes_outlier <- half_hourly_fluxes_small |>

add_row(SW_IN_F = 1100, GPP_NT_VUT_REF = -20)

# Various ways to identify the outlier using graphs

plot_5 <- ggplot(

data = half_hourly_fluxes_outlier,

aes(x = GPP_NT_VUT_REF, y = after_stat(density))) +

geom_histogram(fill = "grey70", color = "black") +

geom_density(color = 'red')+

labs(title = 'Histogram, density and boxplot',

x = expression(paste("GPP (gC m"^-2, "s"^-1, ")"))) +

theme_classic()

plot_6 <- ggplot(

data = half_hourly_fluxes_outlier,

aes(x = "", y = GPP_NT_VUT_REF)) +

geom_boxplot(fill = "grey70", color = "black") +

coord_flip() +

theme_classic() +

theme(axis.text.y=element_blank(),

axis.ticks.y=element_blank()) +

labs(y = expression(paste("GPP (gC m"^-2, "s"^-1, ")")))

plot_7 <- ggplot(

data = half_hourly_fluxes_outlier,

aes(x = SW_IN_F, y = after_stat(density))) +

geom_histogram(fill = "grey70", color = "black") +

geom_density(color = 'red')+

labs(title = 'Histogram, density and boxplot',

x = expression(paste("Shortwave radiation (W m"^-2, ")"))) +

theme_classic()

plot_8 <- ggplot(

data = half_hourly_fluxes_outlier,

aes(x = "", y = SW_IN_F)) +

geom_boxplot(fill = "grey70", color = "black") +

coord_flip() +

theme_classic() +

theme(axis.text.y=element_blank(),

axis.ticks.y=element_blank()) +

labs(y = expression(paste("Shortwave radiation (W m"^-2, ")")))

cowplot::plot_grid(plot_5, plot_7, plot_6, plot_8,

ncol = 2, rel_heights = c(2,1),

align = 'v', axis = 'lr')## `stat_bin()` using `bins = 30`. Pick better value with `binwidth`.

## `stat_bin()` using `bins = 30`. Pick better value with `binwidth`.

A Q-Q Plot depicts the sample quantiles of a variable against the theoretical quantiles of a distribution that is assumed to uderly the data. In the histograms above, GPP looks somewhat Gaussian (normally distributed) but with fatter tails and slightly skewed to the right, while shortwave radiation is clearly skewed to the right, resembling an exponential distribution. The Q-Q plots below reveal that both variables are clearly not normally distributed.

plot_9 <- ggplot(

data = half_hourly_fluxes_outlier,

aes(sample = GPP_NT_VUT_REF)) +

geom_qq() +

geom_qq_line() +

labs(y = expression(paste("GPP (gC m"^-2, "s"^-1, ")")),

x = "Theoretical normal quantiles") +

theme_classic()

plot_10 <- ggplot(

data = half_hourly_fluxes_outlier,

aes(sample = SW_IN_F)) +

geom_qq() +

geom_qq_line() +

labs(y = expression(paste("Shortwave radiation (W m"^-2, ")")),

x = "Theoretical normal quantiles") +

theme_classic()

cowplot::plot_grid(plot_9, plot_10, ncol = 2)

QQ-plots serve to investigate whether the data follows an assumed theoretical distribution. For linear and logistic regression, we would like predictor variables to look as normal, i.e. Gaussian, as possible. You’ve probably learned some of the reasons for this in the Quantitative Methods course (or a similar classical Statistics course), and we will not discuss this further here.

Note however, that neither the histograms, nor the boxplots, or the QQ-plots revealed any evidently suspicious pattern of the added point (shortwave radiation = 1100 W m\(^{-2}\) s\(^{-1}\), and GPP = -20 \(\mu\)mol CO\(_2\) m\(^{-2}\) s\(^{-1}\)) compared to the individual distributions of the two variables. Yet, in Fig. 8.2, the influence of the outlying point on the fit was clear. Because the suspicious observation is off the multivariate pattern in the remaining data, it becomes very influential. That is, it has a big leverage. R provides some useful plots from the fitted regression objects, in particular the “Residuals vs. Leverage” plot:

# Fit regression with outlier

linmod_outlier <- lm(GPP_NT_VUT_REF ~ SW_IN_F,

data = add_row(half_hourly_fluxes_small,

SW_IN_F = 1100,

GPP_NT_VUT_REF = -20))

plot(linmod_outlier, 5)

This plot shows the leverage (see the mathematical definition here) of each observation against the corresponding residual from the fitted linear regression. Points with high leverage, i.e., points that are far from the center of the predictor distribution, and large residuals, i.e., points that are far from the fitted regression line, are very influential. The Cook’s distance (definition here) is an estimate of the influence of a data point in a linear regression and observations with Cook’s distance > 1 are candidates for being outliers. See in the plot above how the point with index 101 (our added outlier) has a very large Cook’s distance. Boundary regions for Cook’s distance equal to 0.5 (suspicious) and 1 (certainly influential) are drawn with a dashed line.

Finally, it’s very important that, before you remove a value because it may be an outlier, you understand where the data came from and if such an abnormal observation is possible. If it depicts an extraordinary but possible situation, this information can be very valuable and it’s wiser to keep it in the model. Interesting research questions arise when data doesn’t align with our preconceptions, so keep looking into it and potentially collect more data.

8.3 Extra material

8.3.1 Classification

Classification models predict a categorical target variable. Note that predictors of a classification model may still be, and often are, continuous. We will introduce a classification problem with a binary target, since it’s straightforward to generalize to categorical variables with more than two classes. As an example, we use the CO2 dataset from the {datasets} package, which contains data from an experiment on the cold tolerance of the grass species Echinochloa crus-galli.

](https://swbiodiversity.org/imglib/h_seinet/seinet/genfield/palexander/set003/Echinochloa_c-g_19Aug06_1595.jpg)

Figure 8.3: Echinochloa crus-galli, image from swbiodiversity.org

We will try to classify the origin of each plant (categorical variable Type with values Quebec or Mississippi) depending on the carbon dioxide uptake rate of the plant (continuous variable uptake measured in \(\mu\)mol m\(^{-2}\)s\(^{-1}\)). More information on the dataset can be obtained by typing ?datasets::CO2 in the console.

datasets::CO2 |>

ggplot(aes(x = uptake, y = Type, color = Type)) +

geom_point(size = 3, alpha = 0.5) +

theme_classic() +

labs(x = expression(paste("Uptake (", mu,"mol CO"[2], " m"^-2, "s"^-1, ")"))) +

theme(legend.position = "none")

At first sight, it’s easy to see that the carbon uptake is lower for the Mississippi type. Note that other predictors can be included in the model, but we’ll focus on a single predictor. Using this example, we’ll cover logistic regression, its implementation in R and metrics for classification.

8.3.1.1 Logistic regression

Theory

A classification problem is a bit more difficult to write mathematically than a regression problem. Before, the mathematical representation of GPP_NT_VUT_REF ~ SW_IN_F was GPP_NT_VUT_REF\(\;=\; \beta_0 + \beta_1\)SW_IN_F. With the classification model Type ~ uptake, we cannot just write Type\(\;=\; \beta_0 + \beta_1\)uptake because Type is not a number. Hence, the categorical variable must be encoded, in this case 0 represents Quebec and 1 represents Mississippi.

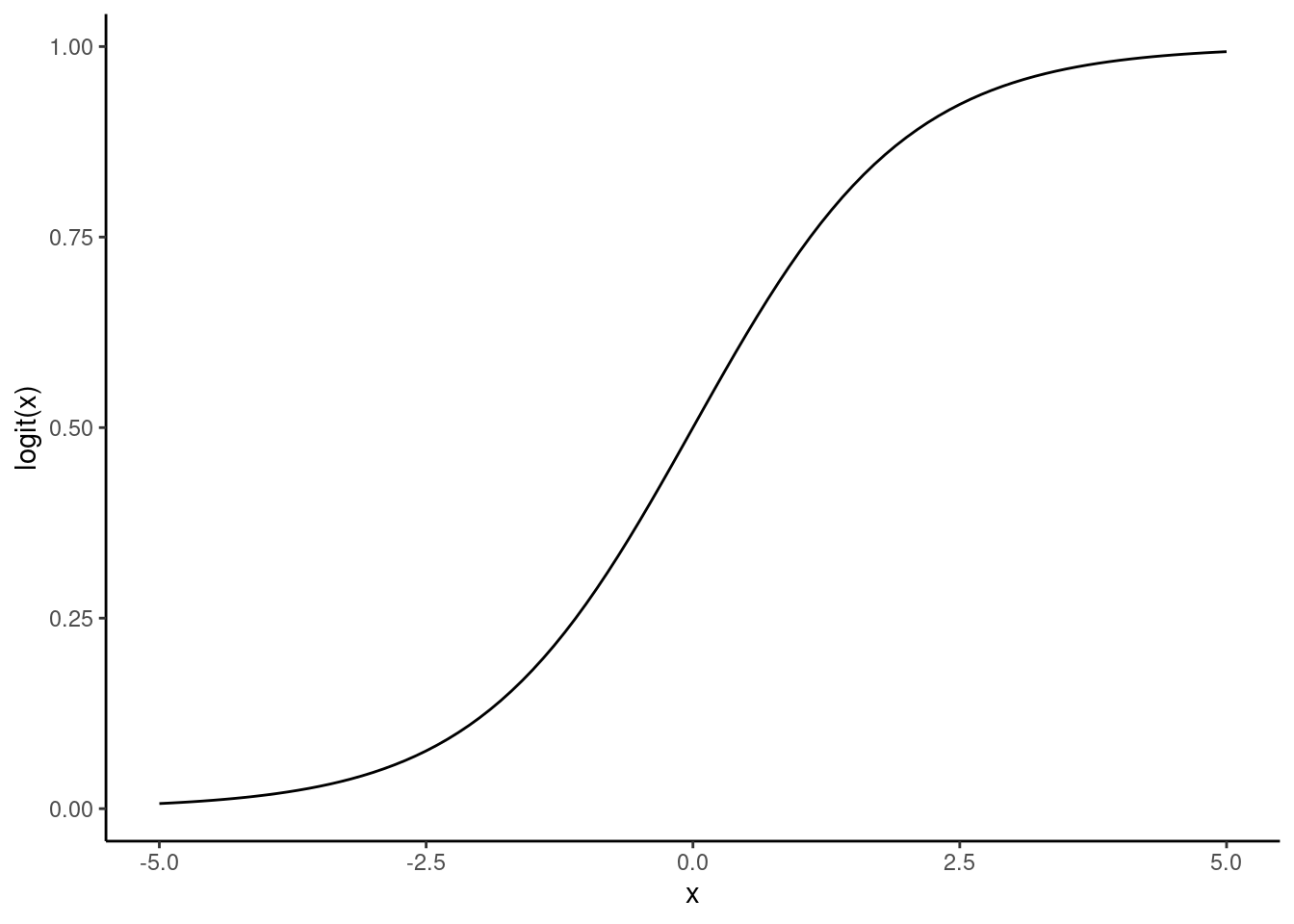

The next issue is that a linear model makes continuous predictions in the entire real numbers space \((-\inf, \inf)\), but we want the predictions to be either 0 or 1. We can transform these values to be in the interval \([0,1]\) with a link function. For a binary response, it’s common to use a logit link function: \[\text{logit}(z) = \frac{\exp(z)}{1+\exp(z)}.\]

ggplot() +

geom_function(fun = function(x) exp(x)/(1 + exp(x))) +

xlim(-5, 5) +

labs(y = "logit(x)", x = "x") +

theme_classic()

Combining a linear model (with any type of predictors, like for regression) and a logit link function, we arrive at the logistic regression model:

\[f(X, \beta) = \text{logit}(\beta_0 + \beta_1 X_1 + ... + \beta_p X_p) = \frac{\exp(\beta_0 + \beta_1 X_1 + ... + \beta_p X_p)}{1 + \exp(\beta_0 + \beta_1 X_1 + ... + \beta_p X_p)}.

\] This predicted value can be understood as the probability of belonging to class 1 (in our example, Mississippi). A classification rule is defined such that an observation \(X_{new}\) with a predicted probability of belonging to class 1 higher than a given threshold \(\tau\) (i.e. \(f(X_{new}, \beta) > \tau\)) will be classified as 1. If the predicted probability is smaller than the threshold \(\tau\), it will be classified as 0.

A logistic regression model results in a linear classification rule. This means that the \(p\)-dimensional space will be divided in two by a hyperplane, and the points falling in each side of the hyperplane will be classified as 1 or 0. In the example above with carbon uptake as predictor, the classification boundary would be a point dividing the real line. If we include a second predictor, we would obtain a line dividing the 2-dimensional plane in two.

Furthermore, to fit a logistic regression model means to calculate the maximum likelihood estimator of \(\beta\) with an iterative algorithm. We will learn more about iterative model fitting, i.e. parameter optimization, in the context of supervised machine learning (Chapter 10).

Implementation in R

First, let’s see how the target variable is encoded. R directly loads the dataframe with Type as a factor and Quebec as the reference level. R factors work such that each factor level (here Quebec and Mississippi) corresponds to an integer value (its position given by levels(), here 1 and 2 respectively). We can fit a logistic model in R with this encoding.

str(datasets::CO2)## Classes 'nfnGroupedData', 'nfGroupedData', 'groupedData' and 'data.frame': 84 obs. of 5 variables:

## $ Plant : Ord.factor w/ 12 levels "Qn1"<"Qn2"<"Qn3"<..: 1 1 1 1 1 1 1 2 2 2 ...

## $ Type : Factor w/ 2 levels "Quebec","Mississippi": 1 1 1 1 1 1 1 1 1 1 ...

## $ Treatment: Factor w/ 2 levels "nonchilled","chilled": 1 1 1 1 1 1 1 1 1 1 ...

## $ conc : num 95 175 250 350 500 675 1000 95 175 250 ...

## $ uptake : num 16 30.4 34.8 37.2 35.3 39.2 39.7 13.6 27.3 37.1 ...

## - attr(*, "formula")=Class 'formula' language uptake ~ conc | Plant

## .. ..- attr(*, ".Environment")=<environment: R_EmptyEnv>

## - attr(*, "outer")=Class 'formula' language ~Treatment * Type

## .. ..- attr(*, ".Environment")=<environment: R_EmptyEnv>

## - attr(*, "labels")=List of 2

## ..$ x: chr "Ambient carbon dioxide concentration"

## ..$ y: chr "CO2 uptake rate"

## - attr(*, "units")=List of 2

## ..$ x: chr "(uL/L)"

## ..$ y: chr "(umol/m^2 s)"levels(datasets::CO2$Type)## [1] "Quebec" "Mississippi"To fit a logistic regression in R we can use the glm() function, which fits a generalized linear model, indicating that our target variable is binary and the link function is a logit function. Let’s see the model output:

logmod <- glm(Type ~ uptake,

family = binomial(link = logit),

data = datasets::CO2)

summary(logmod)##

## Call:

## glm(formula = Type ~ uptake, family = binomial(link = logit),

## data = datasets::CO2)

##

## Coefficients:

## Estimate Std. Error z value Pr(>|z|)

## (Intercept) 3.87192 0.87273 4.437 9.14e-06 ***

## uptake -0.14130 0.02992 -4.723 2.32e-06 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## (Dispersion parameter for binomial family taken to be 1)

##

## Null deviance: 116.449 on 83 degrees of freedom

## Residual deviance: 83.673 on 82 degrees of freedom

## AIC: 87.673

##

## Number of Fisher Scoring iterations: 4This fitted model results in a linear classification boundary (discontinued line) that splits the predictor variables space in two. Where that line falls depends on the choice of threshold, in this case \(\tau=0.5\) (see where the grey logistic regression line meets the dashed threshold line). You can see it plotted below:

beta <- coef(logmod)

# reuse previous plot with classification line

datasets::CO2 |>

ggplot(aes(x = uptake, y = as.numeric(Type)-1, color = Type)) +

geom_point(size = 3, alpha = 0.5) +

labs(x = expression(paste("Uptake (", mu,"mol CO"[2], " m"^-2, "s"^-1, ")")),

y = "") +

theme_classic() +

# call glm model fit as part of the plotting

stat_smooth(method = "glm", color = "grey", se = FALSE,

method.args = list(family = binomial),

size = 3) +

# manually plot of logit function with fitted coefficients

geom_function(fun = function(x) exp(beta[1] + beta[2] * x)/(1 + exp(beta[1] + beta[2] * x)),

color = "black", size = 0.5) +

# visualise threshold

geom_vline(xintercept = -beta[1] / beta[2], lty = 2, linetype = "dotted") +

xlim(0, 60)

Most turquoise points fall to one side of the dotted line, representing the threshold \(\tau\), and most reddish points are the other side. This is what we intended. The points that are on the wrong side of the line are mis-classified by the logistic regression model. Our aim is to minimize mis-classification.

Note that, just like for linear regression, a logistic regression model allows to use categorical explanatory variables and polynomial transformations of the predictors to achieve better-fitting classification models.

Model advantages and concerns

One advantage of logistic regression is simplicity. It’s part of the generalized linear regression family of models and the concept of a link function used to build such a model can also be used for various types of response variables (not only binary, but also count data…). You can find more details in this Wikipedia article.

Furthermore, logistic regression allows for an interesting interpretation of its model parameters: odds and log-odds. Odds represent how likely it is to find one class versus the other (e.g., if class 1 is twice as likely as class 0, then we have probabilities \(66\%\) vs. \(33\%\)). The odds are defined as the probability of \(Y\) belonging to class 1 divided by the probabiity of belonging to class 0, and relates to the model parameters as \[\frac{P(Y_i=1)}{P(Y_i=0)} = \exp(\beta_0+\beta_1 X_i).\] So the log-odds are \[\log\left(\frac{P(Y_i=1)}{P(Y_i=0)}\right) = \beta_0+\beta_1 X_i.\] Increases in the values of the predictors affect the odds multiplicatively and the log-odds linearly.

It is easy to extend a logistic regression model to more than two classes by fitting models iteratively. For example, first you classify class 1 against classes 2 and 3; then another logistic regression classifies class 2 against 3.

Nevertheless, logistic regression relies on statistical assumptions to fit the parameters and interpret the fitted parameters. Whenever these assumptions are not met, one must be careful with the conclusions drawn. Other machine learning methods, that will be covered in Chapters 9 and 10, can also be used for classification tasks. These offer more flexibility than logistic regression, are not necessarily linear, and don’t need to satisfy strict statistical assumptions.

8.3.1.2 Metrics for classification

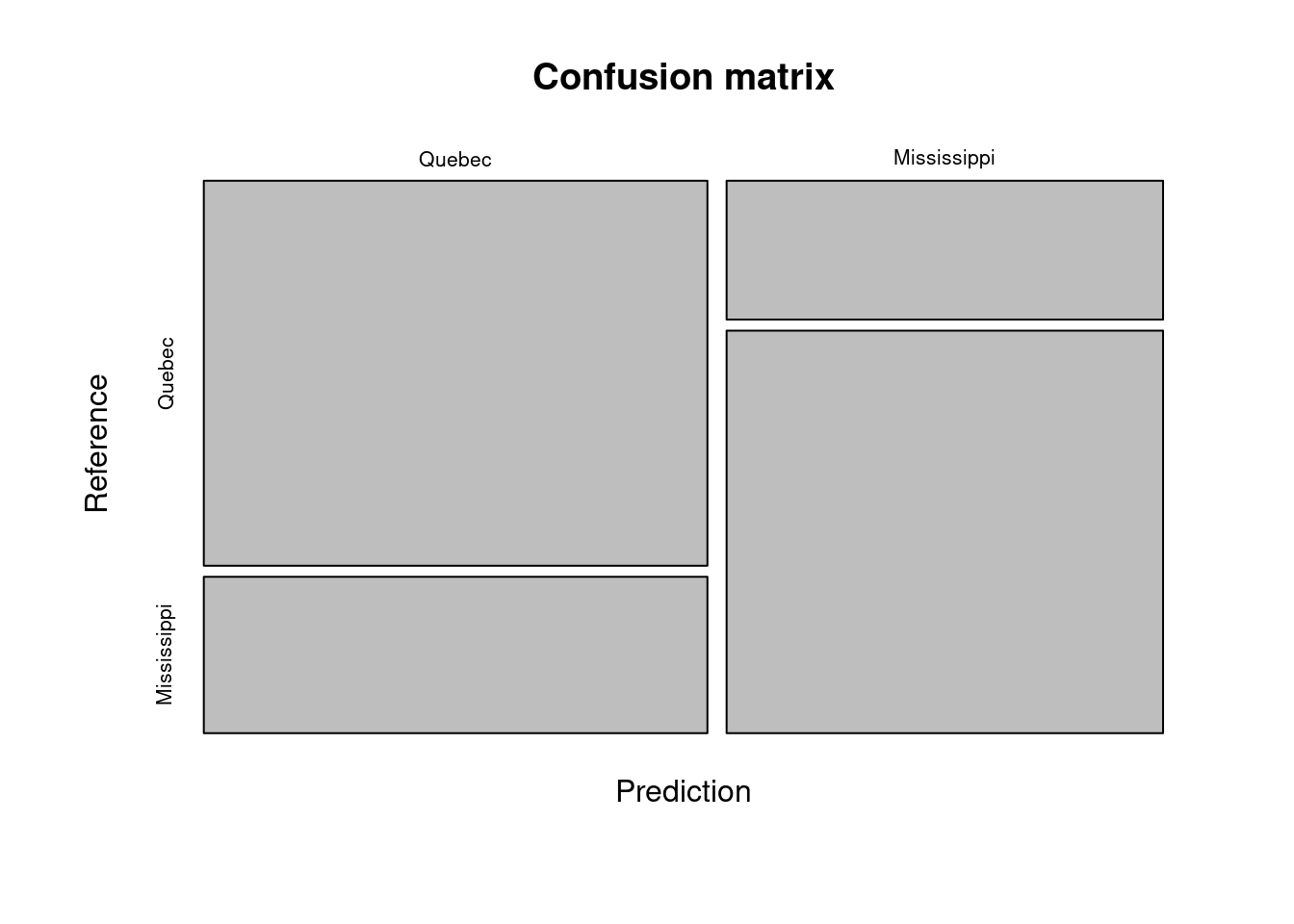

Measuring the quality of a classification model is based on counting how many observations were correctly classified, rather than the distance between the values predicted by a regression and the true observed values. These can be represented in a confusion matrix:

| \(Y = 1\) | \(Y = 0\) | |

|---|---|---|

| \(\hat{Y} = 1\) | True positives (TP) | False positives (FP) |

| \(\hat{Y} = 0\) | False negatives (FN) | True negatives (TN) |

In a confusion matrix, correctly classified observations are on the diagonal and off-diagonal values correspond to different types of errors. Some of these error types are more relevant for certain applications.

Imagine that you want to classify whether the water of a river is safe to drink based on measurements of certain particles or chemicals in the water (Y=1 means safe, Y=0 means unsafe). It’s much worse to tag as “safe” a polluted river than to tag as “unsafe” a potable water source, one must be conservative. In this case, we would prioritize avoiding false positives and wouldn’t care so much about false negatives.

The following metrics are widely used and highlight different aspects of our modeling goals.

- Accuracy is simply the proportion of outputs that were correctly classified: \[ \text{Accuracy}=\frac{\text{TP} + \text{TN}}{N},\] where \(N\) is the number of observations. This is a very common metric for training ML models and treats both classes as equally important. It’s naturally extended to multi-class classification and usually compared to the value \(\frac{1}{C}\) where \(C\) is the number of classes.

Classification models are usually compared to randomness: How much better is our model compared to throwing a coin for classification? At random, we would assign each class \(50\%\) of the time. So if we assume that both classes are as likely to appear, that is, they are balanced, the accuracy of a random guess would be around \(0.5\). Hence, we want the accuracy to be “better than random”. If there are \(C\) different classes and the observations are balanced, we want the accuracy to be above \(1-1/C\).

A challenge is posed by imbalanced classes. For a dataset where \(90\%\) of the observations are from class 1 and \(10\%\) from class 0, always predicting 1 would lead to a accuracy of \(0.9\). This value may sound good, but that model is not informative because it doesn’t use any information from predictors. Therefore, be careful when working with imbalanced classes and interpreting your results.

Precision measures how often our “positive” predictions are correct: \[\text{precision} = \frac{\text{TP}}{\text{TP} + \text{FP}}.\]

The true positive rate (TPR), also called recall or sensitivity measures the proportion of real “positives” (\(Y = 1\)) we are able to capture: \[ \text{TPR} = \frac{\text{TP}}{\text{TP}+\text{FN}}.\]

The false positive rate (FPR) is defined by \[\text{FPR} = \frac{\text{FP}}{\text{FP}+\text{TN}}.\] and is related to another metric called specificity by \(\text{FPR} = 1 - \text{specificity}\).

Receiver operating characteristic (ROC) curve: To evaluate the performance of a binary classification model, it’s common to plot the ROC curve, where the TPR is plotted against the FPR, for varying values of the threshold \(\tau\) used in the classification rule. When we decrease the threshold, we get more positive values (more observations are classified as 1), increasing both the true positive and false positive rate. The following image describes clearly how to interpret a ROC curve plot:

.](figures/Roc_curve.png)

Figure 8.4: ROC curves and how they compare, from Wikimedia Commons.

AUC: The “area under the curve” is defined as the area betwee the ROC curve and the x-axis. For a random classifier we would have AUC = 0.5 and for the perfect classifier, AUC = 1. The aim is to increase the AUC. Nevertheless, a visual inspection of the ROC curve can say even more.

F1: The F1 score is a more sophisticated metric, defined as the harmonic mean of precision and sensitivity, or in terms of the confusion matrix values: \[ F1= 2 \times \frac{\text{precision} \times \text{recall}}{\text{precision} + \text{recall}} = \frac{2 \text{TP}}{2 \text{TP} + \text{FP} + \text{FN}}. \] This metric provides good results for both balanced and imbalanced datasets and takes into account both the model’s ability to capture positive cases (recall) and be correct with the cases it does capture (precision). It takes values between 0 and 1, with 1 being the best and values of 0.5 and below being bad.

These metrics can be used to compare the quality of different classifiers but also to understand the behaviour of a single classifier from different perspectives.

This was an introduction of the most basic classification metrics. For a more information on the topic, check out Kuhn & Johnson (2019), Chapter 3.3.2.

Implementation in R

Let’s take a look at the previous metrics for the logistic regression model we fitted before. The confusionMatrix() function from the {caret} library provides most of the statistics introduced above.

# Make classification predictions

Y <- logmod$data$Type

x <- as.factor(round(logmod$fitted.values)) # Use 0.5 as threshold

# Change class names

levels(Y) <- levels(x) <- c("Quebec", "Mississippi")

# plot confusion matrix

conf_matrix <- caret::confusionMatrix(data = x, reference = Y)

conf_matrix## Confusion Matrix and Statistics

##

## Reference

## Prediction Quebec Mississippi

## Quebec 32 13

## Mississippi 10 29

##

## Accuracy : 0.7262

## 95% CI : (0.618, 0.8179)

## No Information Rate : 0.5

## P-Value [Acc > NIR] : 2.039e-05

##

## Kappa : 0.4524

##

## Mcnemar's Test P-Value : 0.6767

##

## Sensitivity : 0.7619

## Specificity : 0.6905

## Pos Pred Value : 0.7111

## Neg Pred Value : 0.7436

## Prevalence : 0.5000

## Detection Rate : 0.3810

## Detection Prevalence : 0.5357

## Balanced Accuracy : 0.7262

##

## 'Positive' Class : Quebec

## Now we can visualize the confusion matrix as a mosaic plot. This is quite helpful when we work with many classes.

mosaicplot(conf_matrix$table,

main = "Confusion matrix")

8.5 Report Exercise

Although there are a lot of helpful packages and user-friendly functions available, you will often have to write your own data analysis routine. This requires good understanding of statistical knowledge, algorithmic thinking and problem-solving skills. While writing your code, you will face many questions and bugs that you need to solve. And knowing where and how to ask for help properly are crucial parts of this process (see 2.2.3 for more on getting help).

In this Report Exercise, stepwise forward regression is to be performed for the task of modelling GPP as a function of predictors available in the dataset of half-hourly ecosystem fluxes. To learn the skills mentioned above, you will (attempt to) write your own stepwise forward regression from scratch based on the algorithm description of stepwise forward regression in Section 8.2.3.1. The data of half-hourly fluxes can be downloaded from here.

Deliverables for the report

The complete workflow of reading the data, performing the stepwise forward regression, visualising and discussing the results should be implemented in an RMarkdown notebook file and added as file ./vignettes/re_stepwise.Rmd to your git repository. You will then point us to the URL of your repository. We will fork your repository and reproduce the workflow implemented in your notebook. The following aspects should be covered in your notebook:

An evaluation of all bivariate models (single predictor), implementing just steps 1-3 of the algorithm described in 8.2.3.1. This should be complemented by a visualisation and a brief discussion of the results.

An implementation of stepwise forward regression, and a visualisation and discussion of its results. If you face unsurmountable challenges and/or errors you didn’t manage to resolve, your notebook may implement a minimum reproducible example of your code that produces the error or of your attempted implementation of stepwise forward regression.

Guide for your implementation

- Remember the structure of the loops implemented for the Exercise Nested loops in Chapter 2.

- It may be helpful to write a “pseudo-code” that defines the structure of loops and conditionals and defines the points at which certain evaluations and function calls are performed, but cannot be actually run.

- This Stackoverflow post may be helpful for dynamically creating formulas, given a character vector or variable names,

- When discussing results, consider why a certain variable was not chosen in the final model. How do non-included variables relate to variables that are included? How do the model metrics change when adding variables? Can you explain their patterns with your statistical knowledge?

- To better discuss your results, you might want to look up what each variable stands for. More information can be found here.

- Chose an appropriate visualisation for communicating results.

- If you hand in a minimum reproducible example of an unsuccessful implementation of stepwise regression, follow this guideline. Write a minimum reproducible example as if you were addressing an online audience; describe in detail what you goal is, where you got stuck, what the error message is, provide a code example that is runnable without needing any local files.

- Code errors can break knitting your RMarkdown to HTML. To prevent an entire RMarkdown from failing to render because of erroneous code, you can set the respective code chunk as

error = TRUEto avoid render failure while including the error message in the output, oreval = FALSEto avoid running the chunk altogether. More can be found here.